ct sales tax registration

GENERAL INFORMATION ABOUT TAX SALES. Post-Wayfair it has never been more important to understand your sales tax registration obligations.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

If you have questions about the sales tax permit the Connecticut Department of Revenue Services has a guide to sales taxes in Connecticut or can be contacted by calling 800.

. Connecticut State Department of Revenue Services HOLIDAY - The Department of Revenue Services will be closed on Monday October 10 2022 a state holiday. Reason for Filing Form REG-1. Sales Tax Registration What Is It and Why Do You Need To Do It.

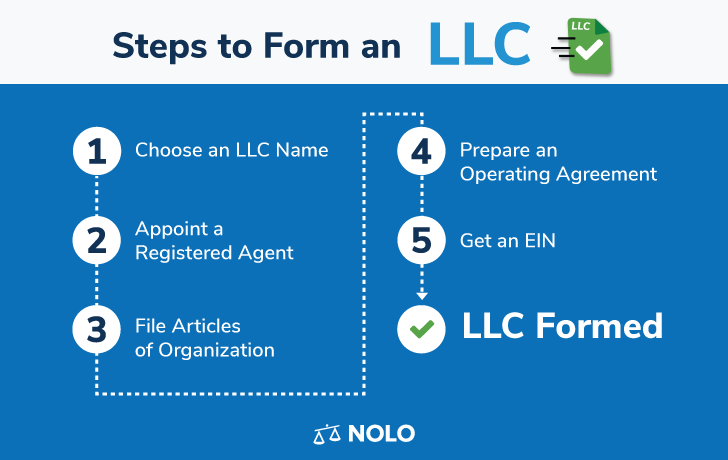

Fill out form REG-1 and remit it along with a check for Connecticuts sales tax permit application fee of 100 to. Either your session has timed-out or you have performed a navigation operation Ex. Identify all your licensing and registration requirements to start your business.

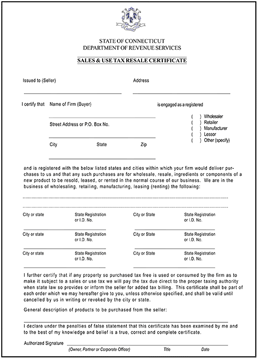

Sale of computer and data processing services. If you are registered for or are registering for sales and use taxes you do not need to complete this section. A tax at the general rate of 635 is imposed by the state on most sales of tangible personal property and on most services enumerated in Section 12-407 of the Connecticut General.

800 524-1620 Connecticut State Sales Tax Online. Using Back Button of the browser that is not. Please check the applicable box.

Department of Revenue Services State of Connecticut. If you do not have a Connecticut Tax Registration Number or need to register additional locations register your business online. If you do not.

Contact the Connecticut Business Hotline. Informational CHECKLIST to aide you in creating your business entity. Registering online provides several key advantages.

You may register for most taxes online using the Taxpayer Service Center TSC. Please do not call the municipality or its attorney with questions about tax sale properties or procedures until after you have thoroughly reviewed. Visit myconneCT now to file pay and.

If you register online and there is a fee you must make direct payment from your savings or checking. Opening a new business including. Business use tax is due when a business purchases taxable goods or services.

MyconneCT is the new online hub for business tax needs. While the general sales and use tax rate is 635 other rates are imposed under Connecticut law as follows. AAn existing out-of-state business opening a location in Connecticut or.

The current sales tax in Connecticut is 635 for vehicles that are 50000 or less. According to Connecticuts Department of Motor Vehicles DMV you must pay a 635 percent sales tax or 775 percent sales tax on vehicles over 50000 upon the purchase. This means that if you purchase a new vehicle in Connecticut then you will have to pay an.

Only the Connecticut Department of Revenue Services can issue Connecticut tax registration numbers for sales tax withholding tax and all other state taxes we administer. Connecticut Department of Revenue Services - Time Out. Now you can file tax returns make payments and view your filing history in one location.

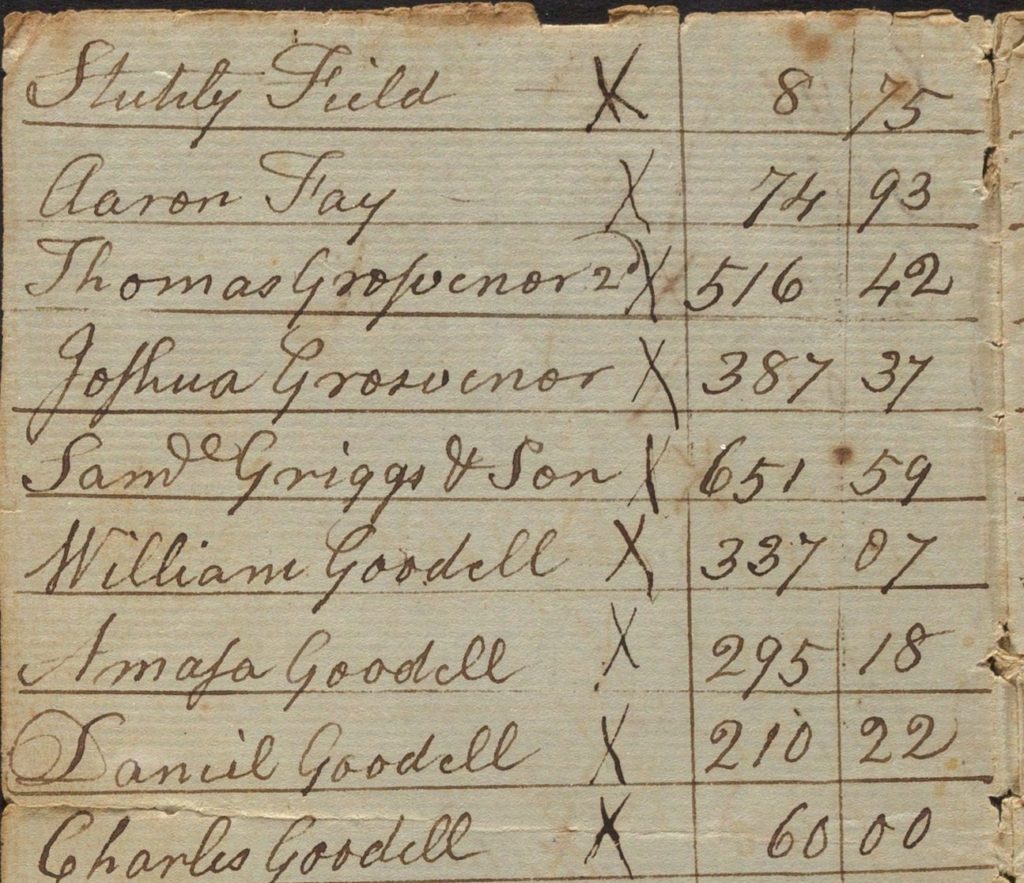

The Connecticut Poll Tax Connecticut History A Cthumanities Project

How To Get A Connecticut Sales Tax Permit Connecticut Sales Tax Handbook

Form Reg 8 Fillable Farmer Tax Exemption Permit

Checklist For Starting A Business In Ct Score

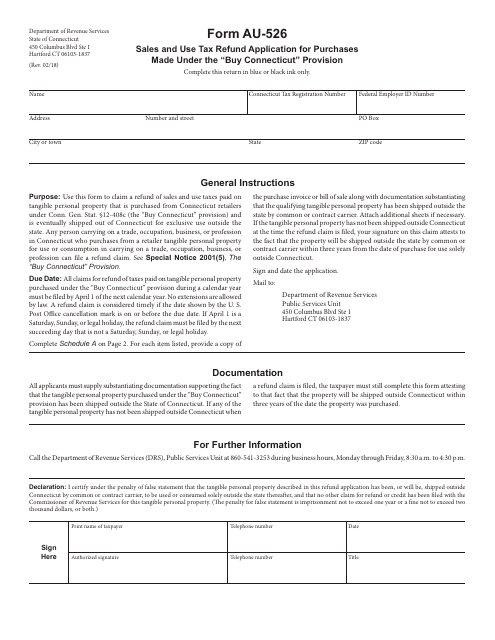

Form Au 526 Download Printable Pdf Or Fill Online Sales And Use Tax Refund Application For Purchases Made Under The Buy Connecticut Provision Connecticut Templateroller

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars

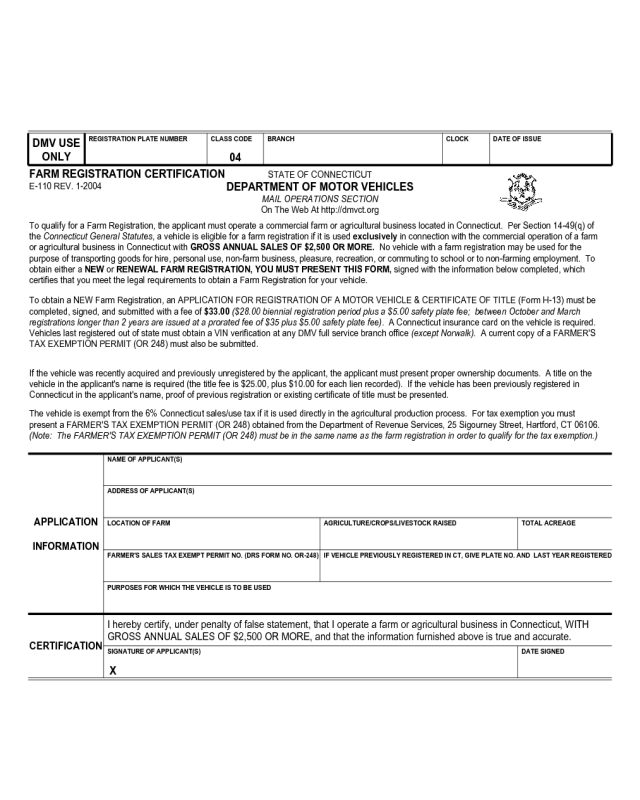

Farm Registration Certification Connecticut Edit Fill Sign Online Handypdf

What Do I Need To Enroll In Autofile For Connecticut Taxjar Support

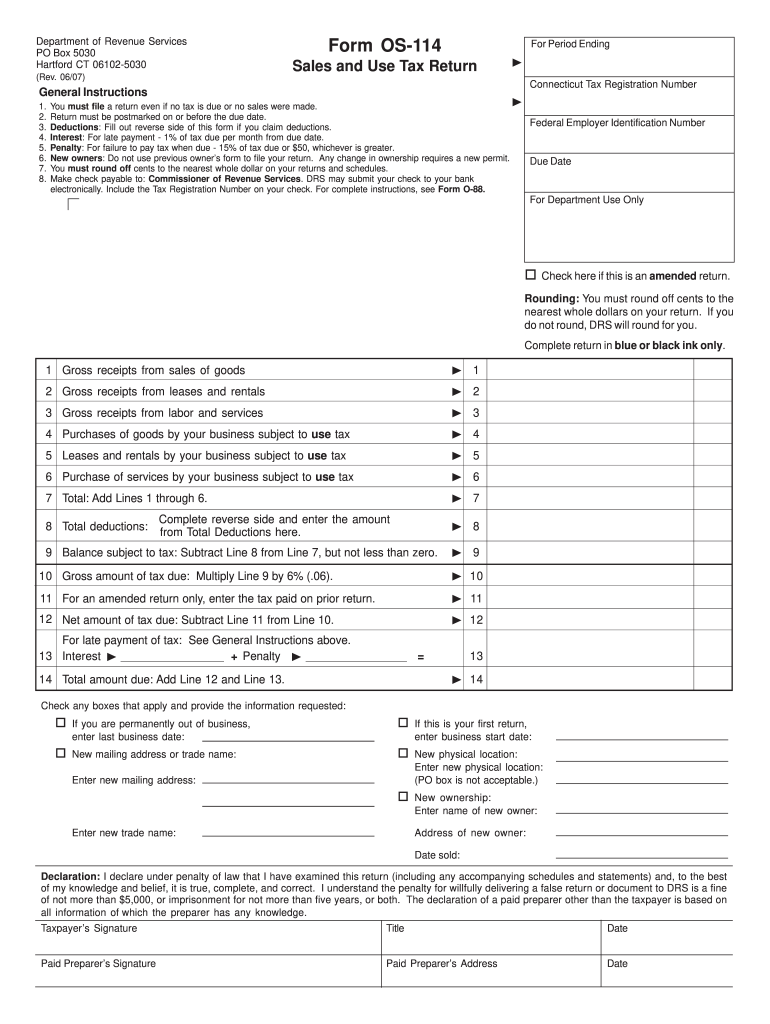

Os 114 Fill Out Sign Online Dochub

Form Ct 10 Fillable Ct 10 Communications Sales And Use Tax Certificate Of Exemption

Car Tax By State Usa Manual Car Sales Tax Calculator

How To File And Pay Sales Tax In Connecticut Taxvalet

Cert 135 Reduced Sales And Use Tax Rete For Motor Ct Gov Fill Out Sign Online Dochub

When Is Your State S Tax Free Weekend In 2022

Credit Applications Tarantin Industries

Connecticut U S Small Business Administration

Ct Senate Republicans Call For Sales Tax Reduction Connecticut Senate Republicans