aurora co sales tax rate 2021

Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month. The Aurora Colorado sales.

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

Aurora Cd Only in Colorado has a tax rate of 7 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora Cd Only totaling 41.

. The 8 sales tax rate in aurora consists of 29 colorado state sales tax 025 adams county sales tax 375 aurora tax and 11 special tax. The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64. The minimum combined 2022 sales tax rate for Aurora Missouri is.

Updated 12021 Effective July 1 2006 the. The County sales tax. Aurora-RTD 290 100 010 025 375.

Effective January 1 2007 the Adams County Sales Tax rate increased from 07 percent to 075 percent. Ad Lookup State Sales Tax Rates By Zip. Free Unlimited Searches Try Now.

What is the sales tax rate in Aurora Colorado. The Aurora sales tax rate is. Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2.

The following list of Ohio post offices shows the total county and transit authority sales tax rates in most municipalities. The December 2020 total local sales tax rate was also 8000. Aurora Sales Tax Rates for 2022.

Download tax rate tables by state or find rates for individual addresses. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city. The County sales tax rate is.

The Colorado sales tax rate is currently. Method to calculate Arapahoe County sales tax in 2021. 2 Rate includes 05 Mass Transit System MTS in Eagle and Pitkin.

Annually if taxable sales are 4800 or less per year if the tax is less than. 24 lower than the maximum sales tax in CO. The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special.

The 9225 sales tax rate in Aurora consists of 4225 Missouri state sales tax 25 Lawrence County sales tax and 25 Aurora tax. 2021 COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. 1 Reduced collection of sales tax from certain businesses in the area subject to a Public Improvement Fee.

The average sales tax rate in colorado is. Aurora Sales Tax Rates for 2022. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes.

The Aurora Cd Only Colorado sales tax is 700 consisting of 290 Colorado state sales tax and 410 Aurora Cd Only local sales taxesThe local sales tax consists of a 025 county. This is the total of state county and city sales tax rates. The Missouri sales tax rate is currently.

Download tax rate tables by state or find rates for individual addresses. 2020 rates included for use while preparing your income tax deduction. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

You can find more tax. The current total local sales tax rate in Aurora CO is 8000. 0375 lower than the maximum sales tax in MO.

This is the total of state county and city sales tax rates. This rate includes any state county city and local sales taxes. Please select a specific location in Colorado from the list below for specific Colorado Sales Tax Rates for each location in 2022 or.

Ad Lookup State Sales Tax Rates By Zip. The minimum combined 2022 sales tax rate for Aurora Colorado is. Tax Rate Changes Modifications.

Free Unlimited Searches Try Now. On November 2 2004 voters approved a ballot. Aurora OR Sales Tax Rate.

The Colorado sales tax rate is currently. Method to calculate Aurora sales tax in 2021.

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Sales Tax By State Is Saas Taxable Taxjar

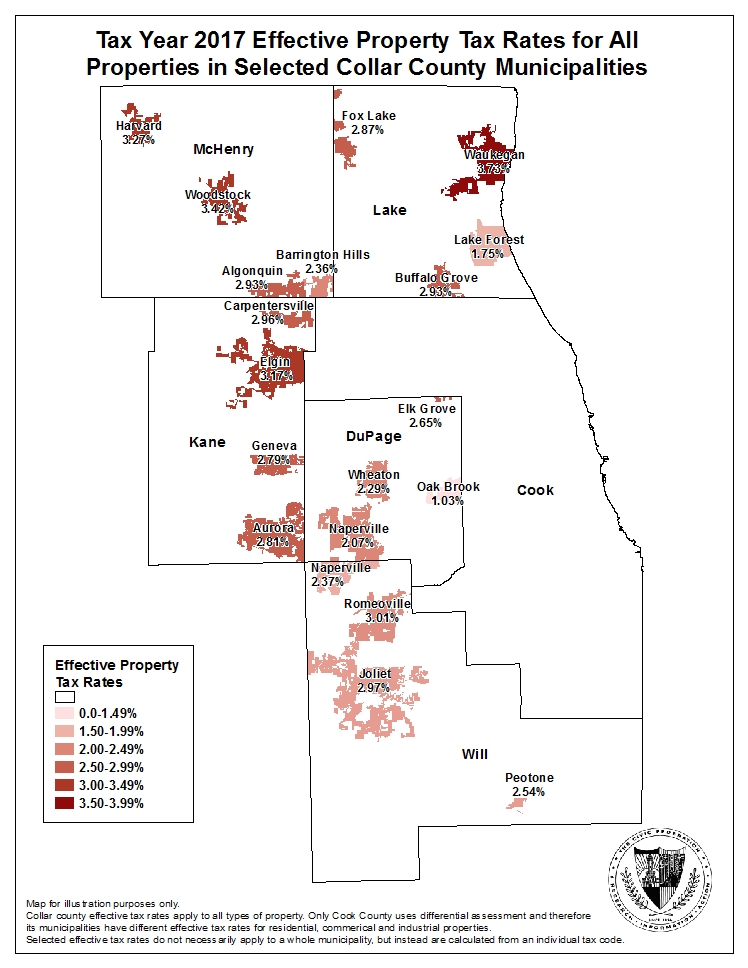

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

U S Property Taxes Comparing Residential And Commercial Rates Across States The Journalist S Resource

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

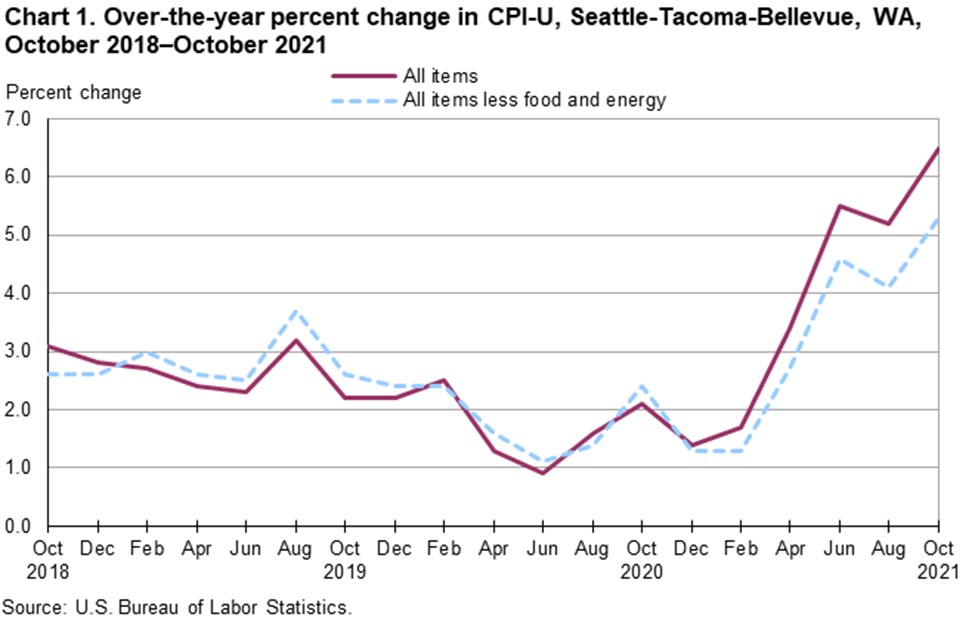

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Colorado Sales Tax Rate Changes In June 2022

Nebraska Sales Tax Rates By City County 2022

Set Up Automated Sales Tax Center

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

How To Apply For A Colorado Sales Tax License Department Of Revenue Taxation